What is Internettradeshowlist.com?

Intertradeshowlist.com is a site that historically has listed trade shows in many different categories but has now decided to focus on Finance, Banking, and DeFi trade shows and summits as we no longer have the time, resources, or knowledge to monitor all different types of trade shows. We choose to focus on finance shows to be able to keep providing valuable information, even if to a smaller group of readers than before. If you are interested in finance summits, then I hope you keep visiting our site.

What are trade shows?

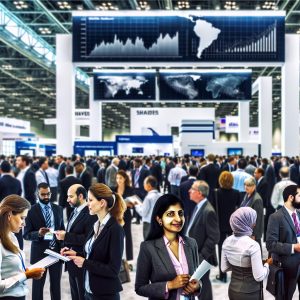

In a time where webinars, newsletters, and online meetings have grown prominent in the information cycle, the idea of spending several days walking through a crowded conference center might seem outdated. But in the world of finance and banking, trade shows continue to play a quiet but important role.

They remain one of the few places where real conversations happen face to face, with out any screens between us. Where deals get started not over Zoom, but over coffee. Where emerging trends aren’t filtered through marketing copy, but debated openly on panels and backroom chats. For professionals across trading, investment, fintech, compliance, and institutional banking, the right trade show still offers something hard to replicate online: direct access to the people shaping the future of the industry.

Understanding why these events still matter—and how they’ve evolved—is key to deciding whether they’re worth your time, money, or brand presence.

The Changing Role of the Trade Show

Historically, trade shows were about visibility. They offered banks, platforms, and financial services firms a physical space to show off products, launch platforms, and compete for attention. But that role has shifted. In today’s environment, many product demos and onboarding journeys happen online. This makes the function of a trade show less about showing off and more about qualifying leads, deepening relationships, and understanding how the industry is reacting to regulatory, political, or technological shifts in real time. What used to be a show-and-tell is now a space for deal-making and strategic positioning. Panels are less scripted. Conversations are more frank. People come in not to be sold to, but to find alignment—on tech, on regulation, or on capital allocation. For brokers, wealth managers, institutional investors, and fintech startups alike, that makes these events more useful—not less.

Real-World Access to Decision Makers

Despite the rise of digital tools, relationship-building in finance still leans heavily on trust. And trust is built faster in person. The people attending these shows—CEOs, CIOs, risk heads, product leads—aren’t just there to collect swag bags. They’re there to gather intelligence, sense market sentiment, and make decisions they wouldn’t risk outsourcing to an email chain. This gives exhibitors and attendees a rare opportunity: time in front of decision-makers who usually delegate conversations elsewhere. Whether you’re pitching a trading platform, looking for B2B partnerships, or simply trying to get a sense of where institutional capital is flowing, these interactions are hard to replicate on LinkedIn.

The Fintech Layer Has Changed the Game

What used to be a space for traditional banks and financial institutions has been flooded with fintech in the last decade. Open banking, embedded finance, real-time payments, AI compliance tools, ESG data solutions—these are the conversations now happening alongside traditional panels on rates, liquidity, and policy.

That shift hasn’t diluted the value of trade shows; it’s broadened it. Now, a portfolio manager might sit next to a payments engineer on a panel. A compliance officer might swap business cards with a startup founder building regtech for crypto funds. The crossover isn’t just tolerated—it’s expected. The mix of legacy players and agile upstarts has added a level of energy that many industry veterans didn’t expect to see again in this setting.

Larger institutions are increasingly using trade shows not just to present, but to scout. Partnerships, acquisitions, vendor relationships—all of these are being shaped by conversations that begin in-person and off the record.

Content Still Drives Attendance—But Only If It’s Sharp

While most attendees now show up with a focused schedule and clear priorities, the quality of a trade show’s content still plays a major role in whether it’s worth attending. It’s not enough to have a big name on the banner. The panels need to deliver useful, current, unscripted perspectives. This is especially true in banking and trading, where many of the key challenges—liquidity fragmentation, market access, regulation, FX transparency, digital assets integration—are still being figured out in real time. The value of a live discussion isn’t the final answer. It’s seeing where the market disagrees, who’s actually solving the problem, and which institutions are lagging behind.

Strong panels, direct Q&A, and candid interviews now define the best events. Gone are the days of vague keynote speeches and jargon-packed slide decks. People want specifics, live data, and open disagreement. And the trade shows that allow space for that win more credibility than those that filter everything through PR.

Measuring Value in More Than Leads

For firms attending or exhibiting, the goal of a trade show used to be leads. But in a high-stakes financial environment, especially across B2B services and institutional trading, the definition of value has matured. It’s now about pipeline conversations that close three quarters later. It’s about competitor intel that sharpens your go-to-market strategy. It’s about learning what your clients are really worried about when the mic is off. Whether you walk away with signed contracts, media coverage, or five conversations that shape your road-map for the next year, the return on investment is rarely visible by the end of the week—but that doesn’t make it less real.

Trade Shows Aren’t Dying—They’re Getting Smarter

There’s no question that the trade show model has had to adapt. The hybrid event trend made many shows rethink how they deliver value. Some will fade. But the strongest ones are doing better than ever—because they’ve moved beyond sales theater and into real strategy space.

Finance and banking professionals don’t need more polished information. They need context, connection, and stuff that can help them make decisions in a fast-changing world. The right trade show still offers that. Not all of them do—but the ones that matter have figured out how to cut through the noise and create space for conversations that count.

For firms serious about building market presence, tracking industry movement, or accelerating institutional partnerships, attending the right events still matters. And the best opportunities often show up between panels, not on them.

While many trade shows are global in name, most draw a core regional audience. That means attending events in specific markets—London, Frankfurt, Singapore, Dubai—often gives you far deeper access to regional trends and buying behaviors than you’d get from global online content.

About Trade Shows

-

The Impact of Financial Trade Shows on Global Investing Trends

-

How to Attract High-Quality Attendees to Your Booth at an Investment Expo

-

The Dos and Don’ts of Networking at Financial Conferences

-

How to Prepare an Effective Elevator Pitch for a Trade Show

-

The Best Financial Trade Shows for Cryptocurrency and Blockchain

-

What Investors Look for at Financial and Trading Expos

-

The Future of Financial Trade Shows: In-Person vs. Virtual Events

-

How to Leverage Financial Trade Shows for Career Growth

Examples of Financial, Trading and Banking Trade Shows, Summits and Conferences

In an industry where speed, precision and regulation dominate the headlines, it’s easy to forget that the financial world still runs on relationships. That’s why, despite the digital age reshaping how people work and communicate, trade shows in finance, trading and banking remain powerfully relevant. Therefore, these events aren’t just about panels and product demos – they are gathering points for decision-makers, deal-closers, regulators, startups and institutions all looking for a strategic edge. The biggest shows draw global talent and serious money.

It’s easy to dismiss trade shows in an industry that moves as fast as finance. But even as platforms become automated and decision-making shifts to real-time data, the need for physical presence hasn’t disappeared. If anything, it’s become more valuable. These events don’t replace technology—they give it context. They aren’t just about networking—they’re about negotiating, signaling, and understanding where the money is actually moving next. In a world flooded with surface-level insight, they remain one of the few places where real-time thinking and long-term strategy come together. For firms serious about expansion, credibility, or market intelligence, being present at the right events isn’t about optics.

Financial services shows are usually industry shows and are seldom open to the public. They allow for networking and they allow banks and financial institutions to sell their services to financial advisors and other resellers. There are generally financial shows where many different types of exhibitors promote their services. There are also more target financial shows. An example of this is Forex shows. Forex shows allow forex brokers and other forex service providers to promote their services to affiliates and resellers. They get to try to convince the attendees that they offer the best brokerage, the best forex signal or the best forex software. Luckily there are websites like DayTrading where you can read honest review and the opinions of other traders to find out the truth before you register with a forex trading platform.

Similar shows are held for CFDs, binary options and many other financial instruments.

Sibos

Run by SWIFT, Sibos has grown into one of the more influential events in global banking. It brings together thousands of financial institutions, regulators, central banks and technology firms in a format that blends traditional banking concerns—payments, compliance, cross-border settlement—with the cutting edge of fintech and data-driven banking.

What makes Sibos special isn’t just the size but the quality of its participants. It’s where central bankers bump into crypto founders, and where serious conversations happen around financial messaging standards, infrastructure upgrades, and the future of money movement. For institutions tied into global finance, it’s the one event where policy, platform, and pipeline all meet in the same room.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT, also known as S.W.I.F.T. SC) is a cooperative established in Belgium in 1973. SWIFT is owned by banks and other member firms, and provide the largest network for international bank payments. Among other things, SWIFT is also responsible for assigning ISO 9362 Business Identifier Codes (BICs) – the so called “Swift codes” that have become so important for international bank transfers. As a major player in the world of finance, Swift has established their annual Sibos conference as the place to be for the financial services industry.

Sibos is a conference, exhibition and networking event that attracts thousands of attendees each year, including business leaders, topic experts, and decision makers. So far, the Sibo with the highest attendance was the 2019 Sibo in London, with roughly 11,500 participants.

Previously known as the SWIFT International Banking Operations Seminar, Sibo was established in 1978. While Swift is headquartered in La Hulpe near Bussels in Belgium, Sibos is held in a different city each year. Originally being held in European cities only, Sibos eventually branched out to North America (Washington, DC 1982), Asia (Hong Kong, 1991), and Oceania (Sydney, 1997).

TradeTech Europe

Held annually in Europe, TradeTech Europe is focused on equity trading, with special attention on the European trading ecosystem. Institutional traders, asset managers, brokers, exchanges, regulators and representants for large websites such as Investing.co.uk come together to discuss topics such as execution quality, automation, dark pools, algorithmic trading, and market structure. What sets TradeTech apart most is this attention to the actual mechanics of trading. Panels dive into issues like best execution, data latency, post-trade analytics, and the evolving role of buy-side desks. It’s not about theory—it’s about what’s working on the screens today and how firms are responding to regulatory shifts like MiFID II or T+1 settlement cycles. For firms involved in equities—especially on the institutional side—it’s one of the few events that goes deep enough to offer practical insight while still drawing global-level attendees.

FIX Events

They don’t make the splashy headlines, but FIX events, organized by the FIX Trading Community, are some of the most technically significant gatherings in the trading industry. FIX is a global messaging standard for electronic trading—and the community behind it runs events that focus tightly on interoperability, infrastructure, latency, and market connectivity. FIX events are not for casual attendees. They’re where CTOs, heads of trading infrastructure, and platform architects sit down to figure out what’s next in multi-asset trading and how markets stay connected and compliant. The discussions might not trend on social media, but they shape how trading desks actually function. For many experts and decision makers involved in execution, order routing, or the creation of institutional-grade trading tools, the FIX events are essential.

The Fix Trading Community is non-profit standards body. Initiated in 1992, the Financial Information eXchange (FIX) protocol is an electronic communications protocol for international real-time exchange of information related to securities transactions and markets, and understanding the FIX protocol is for instance important for managing the delivery of trading applications and keeping latency low.

The FIX protocol was developed to enable electronic communication of equity data between Fidelity Investments and Salomon Brothers, but grew into something much bigger. Before FIX, information between broker-dealers and their institutional clients were communicated through phone calls. Today, FIX is an incredibly important messaging standard for pre-trade and trade communication in global equity markets, and it is currently expanding into the post-trade space. In addition to this, FIX is also increasingly being used in other markets than equity, including forex and bonds.

Since FIX is widely used by both the buy side (institutions) and the sell side (brokers/dealers), both sides are present at FIX events. Examples of FIX user categories that tend to attend are investment banks, stock exchanges, ECNs, large mutual funds, and brokerage companies.

Money20/20

While many trade shows lean on legacy finance, Money20/20 made its name by focusing on where finance is going, not where it’s been. With major events in Europe, the US and Asia, it’s focused on topics such as fintech, digital payments, banking-as-a-service, open finance, embedded finance, and blockchain infrastructure.

Money 20/20 draws major banks, challenger banks, VCs, payment providers, and tech giants. The tone is faster, sharper and more product-driven than many other events, reflecting the industry’s shift toward API-first business models and mobile-first consumer services. Unlike traditional conferences, Money20/20 isn’t shy about blending hype with substance—but that’s part of its appeal. It has become a critical event for any institution or provider trying to stay relevant in a market being rapidly redefined by tech.

Dubai Fintech Summit

Established as a part of Dubai’s push to position itself as a global fintech and banking hub, the Dubai Fintech Summit is today the region’s flagship financial event, attracting banks, regulators, startups, and capital from across the Middle East, Africa, Asia and beyond.

The conversations here often bridge traditional finance and emerging market dynamics. It’s not just about products—it’s about infrastructure, access, and building systems that scale across markets with different levels of regulation and digitization.

The Dubai Fintech Summit also acts as a showcase for Dubai’s broader ambitions. The event provides exposure to regional innovation, including Islamic finance, real-time payments infrastructure, and blockchain-based solutions for cross-border trade. For firms looking to tap into fast-growing but underrepresented markets, this is a strategic stop.

The FinTech World Cup is one of the high points of the summit program, allowing finalists from around the world to battle it out on the FinTech Innovation Stage, showcasing their skills, creativity and drive.This is the place to be if you want to see trailblazing solutions presented, as participants compete for investment prizes and mentorships.

Future of Finance

Future of Finance events are designed to cut through the noise and take a long view. While smaller in scale than some of the trade giants, they attract high-level professionals looking for strategic insight into the direction of banking, capital markets and financial regulation. The agenda leans into themes like digital transformation, climate risk, systemic resilience, central bank digital currencies, and the blurring lines between banking and tech.

Future of Finance is a space where big questions get asked—and sometimes answered—without the filter of immediate commercial goals. This slower, more thoughtful tone gives it a place alongside the larger shows. For those responsible for strategy, policy or long-term investment planning, it adds perspective that’s often missing from more product-driven events.

Global Fintech Fest

Global Fintech Fest (GFF) is a large annual fintech conference organized by the Payments Council of India (PCI), the National Payments Corporation of India (NPCI), and the Fintech Convergence Council (FCC).

Global Fintech Fest is also arranging satellite events known as the Global Fintech Fest Dialogues. Hosted in collaboration with Indian Missions globally, the GFF Dialogues are a series of exclusive engagements that bring together regulators, policymakers, and industry leaders to discus the future of financial services and foster cross-border collaboration. Examples of important topics during GFF Dialogues are regulatory changes, emerging trends in fintech, and international cooperation and collaboration.

DigiBank Summit

The DigiBank Summit is a digital banking and fintech summit with a special focus on Africa and Asia. Among other things, DigiBank Summit is renowned for its networking opportunities for participants who wish to be even more active on these vast regional markets.

Examples of topics that are usually covered through panel discussions and breakout sessions during the summit are digital banking security, mobile banking developments on emerging markets, national and cross-border regulation, big data analytics, and AI in banking.

Over the years, the DigiBank Summit has developed a reputation for being a great place for fintech start-ups to present disruptive technology and banking solutions that need more traction in Africa and Asia.

The DigitBank Summit has spawned of into numerous editions, hosted by different countries in Africa and Asia, such as the Ethiopia Edition, Uganda Edition, Kenya Edition, Indonesia Edition, and Philippines Edition. The Digibank Summit and its many national editions have become a catalyst for transformation.

Taking place in Addis Ababa, a notable financial hub for the Horn of Africa region, the Ethiopia Edition of the DigitBank Summit has served to shine a light on Ethiopia’s current struggle to effectively transform the national banking sector and provide a largely unbanked or underbanked population of 100+ million people with useful access to bank account and services. DigiBank Summit´s successful collaborations with both the Ethiopian government and Ethiopian civil society have underscored the country´s commitment and eagerness to take the required steps towards fully embracing fintech solutions on a national scale.

Over 2000 km away from Addis Ababa, the Uganda Edition of the DigiBank Summit – held in Kampala – deals with a considerably more developed market, even though Uganda is still considered an emerging market. Home to roughly 50 million people, Uganda has 25 licensed banks and over 80 registered fintech companies. Mobile phones are in widespread use, and data from 2023 showed a mobile phone penetration around 65%. It is a market that scores of more advanced and niche fintech companies are very eager to get into, and the DigiBank Summit Uganda Edition reflects that.

Mexico Finance & Fintech Summit

The Mexico Finance & Fintech Summit is a leading international summit for fintech, known for bringing together a diverse spectrum of stakeholders. Here regulators and institutions can connect with investors, fin tech developers, and others, for knowledge-sharing, discussions, and networking.

Mexico is both a major producer of fintech and a major consumer of fintech services, and the country is home to a well-developed financial sector. It is not surprising that the Mexico Finance and Fintech Summit is attracting attendants from far and wide, rather than begin limited to a domestic affair.

Examples of topics that are normally covered by this summit are digitization of banking and finance, blockchain solutions, cyber security, regulation, artificial intelligence, investment opportunities, and international cooperation.

A lot of effort is currently being put into reaching the substantial parts of the Mexican population that is still unbanked or underbanked, and many countries in a similar situation is hoping to learn valuable insights from the work going on in Mexico. Examples of areas that are at the top of the agenda right now are mobile payment solutions, sending and receiving remittances, and crowdfunding.

What to Expect as a Visitor to a Financial, Trading or Banking Trade Show

Walking into a financial trade show for the first time can be both exciting and overwhelming. Whether you’re attending as an investor, analyst, fintech executive, compliance lead or trader, you’re stepping into an environment designed to be fast, focused and full of moving parts. These aren’t consumer expos. They’re built for deal-making, intelligence gathering and building relationships in a sector that rarely slows down.

Expect intensity.

Expect scale.

Expect to leave more informed than when you walked in—if you know what to look for.

A Mix of People

Financial trade shows bring together a wide mix of people, even if they all seem to be wearing dark blue. You’ll run into heads of trading desks, junior fintech founders, compliance analysts, regulatory reps, asset managers, and tech providers. The conversations are formal, but the people behind them are varied. You’ll find the quiet dealmakers sitting next to the fintech marketers, and they’re usually both there for the same reason: access. Unlike digital meetups or webinars, these events offer real-time exposure to how your peers are thinking—what they’re prioritising, what they’re worried about, and who they’re watching. It’s one of the few times the industry steps out from behind screens and actually shows its face.

Panels

Most visitors arrive with a rough idea of what sessions they want to attend. The reality is, some panels will exceed expectations while others will feel like they’re reading from a press release. The trick is not to over-plan your schedule. Leave space to attend the unexpected. Some of the most valuable panels are the ones that don’t have household names but feature professionals with skin in the game—people building infrastructure, handling regulation, or shaping the real execution process behind the scenes.

When a panel gets interesting, it’s usually because the moderator lets the speakers disagree. The best events make space for real tension: different views on the future of market structure, or how much regulation is too much. That’s when you learn more than you would from a polished brochure or company blog.

Conversations That Aren’t on the Agenda

A lot of the real action at trade shows happens away from the microphone. Those quick chats at a booth, unplanned introductions over coffee, or private meetings tucked away in meeting rooms upstairs—this is where the useful conversations start. As a visitor, you’ll want to balance your time between the main event and the quieter interactions. Don’t worry about having the perfect pitch or job title. Most people are there to learn, share and connect. If you’re clear on what you’re looking for—whether it’s insight, opportunities or partnerships—you’ll find the right people to talk to. And if you’re not? These conversations are how you figure it out.

Noise and Hype

There’s always going to be noise—companies pushing products, branding everywhere, booths offering espresso or champagne just to get a scan of your badge. Don’t be surprised if some interactions feel more like a soft sales pitch than a genuine exchange. But here’s the trade-off: amid the noise, there’s signal. When you find it, pay attention. The booth with no queue but serious product knowledge. The lesser-known firm showing a real fix for a problem that everyone else is still talking about solving. The analyst or regulator who answers your question off-script. These shows are built to sell—but the smart visitors know how to filter. Walk past the gimmicks and ask real questions.

Technology Front and Center

If you’re attending a show focused on trading, banking or finance, expect technology to be everywhere. Whether it’s risk management software, real-time analytics tools, algorithmic execution platforms, or regtech built for compliance teams, the industry is increasingly tech-driven—and it shows.

Product demos aren’t just slideshows anymore. You’ll see live platforms, simulations and integrated tools. You’re not there just to watch. You’re there to interrogate. How does it scale? What’s the latency? What’s the pricing model? This isn’t a place to be passive. The vendors who matter expect serious questions, and the good ones will give serious answers.

You Will Become Tired—and Smarter

You’re going to walk more than you expect. You’re going to talk more than you planned. And if you’ve done it right, you’ll leave more tired and more informed than you thought possible. High quality trade shows aim to compress months of insight, exposure and interaction into two or three days. There’s value in the speed. In just a few hours, you can compare six platforms, test four new tools, talk to ten service providers and hear real-world feedback on the latest regulatory shift. It’s not about collecting business cards or scanning QR codes. It’s about sharpening your understanding of what’s changing in your corner of finance—and figuring out how to move faster or smarter as a result.

What to Expect as an Exhibitor at a Financial, Trading or Banking Trade Show

Exhibiting at a financial trade show can look like a marketing play on the surface—stand design, branded giveaways, smart suits, maybe a flashy screen or two. But underneath that polished layer is real work. It’s about exposure, pipeline, partnership, and signaling strength in a very competitive space.

If you’ve committed to being on the floor as an exhibitor—whether you’re a platform provider, bank, fintech firm, compliance tech vendor, broker, or data company—you’re not there to simply be present with a product. You’re there to start conversations that lead to something bigger. And that means knowing what to expect before the doors open.

Exhibiting at a financial, trading, or banking trade show is a serious investment—not just in money, but in people, time, and attention. Done right, it’s more than just a marketing exercise. It’s a front-row seat to the conversations shaping your industry, a stage for your brand, and a launchpad for real deals.

Don’t show up just to be seen. Show up with purpose, preparation, and people who know how to listen as well as they speak. That’s how you turn a booth into business.

Expect to Put in A Lot Of Work Long Before the Event

By the time your team shows up and starts unpacking branded lanyards and plugging in the monitors, most of the real work should already be done. The success of your presence is built on how well prepared you are. That includes decision about who will be attending, what kind of meetings you’ve scheduled in advance, what your messaging actually says, and what your follow-up plan looks like. If you’re showing up just to “see what happens”, you’re already behind the firms that have pre-booked meetings with target clients or locked in speaking spots to push their narrative. Treat trade shows like a live component of your overall strategy, know before what value you´re offering, and be well prepared to turn interest into action.

Everyone’s Watching—Even If They’re Not Talking to You

Brand visibility matters. In the financial space, showing up at the right events isn’t just about generating leads—it’s about credibility. Exhibiting shows clients and competitors alike that you’re investing in being part of the conversation. That doesn’t mean you need the biggest stand or the flashiest setup. But it does mean your presence should look intentional, professional, and aligned with your brand. Sloppy design, bored staff, and vague messaging get noticed for the wrong reasons. Even when people don’t stop at your stand, they’re still reading your signage, watching who’s visiting you, and remembering whether you looked organized—or overwhelmed.

Conversations Come in Waves

Don’t expect constant traffic. Even at the busiest shows, the flow of visitors to your stand will come in waves—often tied to coffee breaks, lunch sessions, or big panels ending. The quiet spells aren’t a problem. They’re a chance to regroup, prep, and have more meaningful 1:1 conversations when things pick up.

You’ll have a mix of interactions: some purely exploratory, some highly technical, and a few from competitors posing as prospects. The value is in filtering early, keeping the right people engaged, and not getting bogged down with attendees who aren’t your target audience. Having a range of staff on hand—sales, product, marketing, and execs—helps you manage those conversations properly. The right person at the right moment can turn casual interest into a serious lead.

You’re Selling—but You’re Also Listening

Exhibiting isn’t just a broadcast opportunity. It’s a chance to gather real-time market feedback. People will tell you what they’re frustrated with, what they’ve heard about your competitors, and what trends they’re actually acting on—not just reading about. These insights are valuable. They can help shape your product, refine your positioning, or adjust your messaging in real time. The firms that treat a trade show like a live feedback loop get more than just leads, as they leave with sharper market awareness than they walked in with.

Lead Capture Is Just the Beginning

Collecting business cards, scanning badges, or logging demo requests is easy. What you do next is what counts. If you don’t have a fast, structured follow-up plan, expect most of your hard work to fade into inbox oblivion within a week. The best exhibitors start following up within 48 hours—while the conversation is still fresh. They tailor their message, connect it to what was discussed, and keep the momentum going. Trade shows aren’t just about what happens on the floor. They’re about what happens after—when the real business begins.

Not All ROI Is Immediate

You might walk away from the event without a single closed deal. That’s normal. The return on exhibiting is rarely instant. Sometimes, it’s about building brand presence. Sometimes it’s about showing your biggest clients that you’re still leading. Sometimes it’s about one meeting that doesn’t close for six months but turns into something major. The smart exhibitors understand this. They judge success on the quality of conversations, the strength of follow-up opportunities, and whether the market now sees them as a serious player in their space. Over time, that visibility turns into revenue—but only if it’s backed by consistency and a clear strategic goal.

This article was last updated on: May 27, 2025